Before We Start Lets Talk About Palantir

Looking at PLTR, I feel two things:

Happy that I am reading price action and seeing potential correctly

Not as happy that I mishandled my own trade in it recently

I Wrote What I Thought Palantir Would Do In This Post From April 10

And Posted This Chart

What PLTR Actually Did

I bought it as I recommended, on the gap up coming up from its small decline. But my stop loss was too tight. Logically, it would be better for the stop to have been just under the last inside day. A couple ticks makes all the difference.

We are not letting it go, the best entries are after strength, we will stalk it closely going forward, for new entries, and see how it will react on earnings.

Trading is a constant struggle and learning, I hope some of you handled the trade better than I did.

In Last Weeks Market Analysis — We Sensed A Bottom Forming

We Tested The Recent Low And Trapped Some Bears

After Wednesdays horrible gap up, I was sure that we would need to test the lows again. But the market did what it does best — whipping most people around.

After a solid recovery on Thursday we entered the market

For Each Time Resistance Is Tested — It Weakens

This is a known phenomenon in technical analysis, and beautifully demonstrated by this weeks action.

Looking at the S&P 500 in a lower timeframe, the formation got more and more bullish as the week progressed.

The Market Dipped Its Toes In A Bear Market And Ran For Its Life

That is one bullish looking monthly candle - as long as next week doesn’t ruin the fun.

We Have Largely Followed The Road Map That We Made A Month Ago

And The Stock Market Is Choosing The Bullish Scenario - At Least For Now

Trump Isn’t Repairing Anything - But The Market Doesn’t Care Anymore

Which is bullish. During the week, bearish news has been hammering the market, but the market isn’t budging.

This is an indication of news fatigue — meaning a prolonged period of uncertainty might already be priced in.

Not A Time To Pop The Champagne — We Are By No Means Out Of The Woods

This was a bullish first step, the market will try to shakeout some weak hands soon. A gap down the coming week would not surprise me.

It is overly obvious that we might turn back down from here, so don’t be too aggressive on the long side — until we have reclaimed some of the key resistance levels ahead.

Why We Entered On Thursday

I felt pretty bearish after Wednesday. But the key in trading is to keep your execution objective. To be able to change footing quickly — when market dynamic changes.

We entered because leading stocks showed significant strength and because of a phenomenon called lockout rally.

This is a rally that is hated. By all macroeconomic metrics we should probably crash and burn. This rally will be heavily shorted, which paradoxically may fuel its further advance.

A powerful lockout rally is also very hard to buy, as you may have noticed, stocks run relentlessly. Staying outside for too long, also makes you hesitant to enter when we inevitably pullback, believing it is a new crash.

Or you finally enter too late — when the window of opportunity is about to close.

As long as you have calculated your risk, and are entering with small positions, and decent entries — You lose very little by testing the market for feedback.

Todays Market Analysis Is Packed

Key levels ahead and signs that would make us increase our exposure

Breadth and sentiment observations

The Zweig breadth thrust signal

Smart money and commercial hedger positioning

Since retail have a proven track record of bad market timing — we always look at their actions

VIX

Options market positioning and their assessment of the likelihood of a sharp and sudden decline

Gold

Bitcoin

Trade plan going forward and how to handle the imminent pullback after this thrust up

Buckle up!

Next Week Will Probably Be A Bumpy Story

The 50 and 200 day moving average is converging in a single massive liquidity and resistance zone, that will likely be tested next week.

It is normal that we will initially fail here. We are short term overbought and a pullback is likely — and welcome, to form new setups and entry points.

What will be important is the character of the pullback. We want it to be orderly, and we want the liquidity zone we just pierced through, to hold and act like support.

It Is Overly Obvious That We Might Turn Down From Here

This can simply be a bull trap and a powerful bear market rally. Therefore I will not talk a lot about the bearish scenarios today.

If we turn down and our stocks violate their stop loss levels, the market will force us to cash — its that simple.

Instead Lets Look At A Bullish Thesis

Breadth Is Improving - But We Are Still Oversold In The Longterm

Which is good, this can fuel the rally much further. Percent of stocks in the New York Stock Exchange over the 200 day moving average is still only 30%.

Meaning most stocks are still in a longterm downtrend. As they turn up, they can help advance the market further.

The Zweig Breadth Thrust Signal

Martin Zweig developed a breadth thrust signal, that may trigger at significant market trend reversals. I will not go into the calculations, since that is not interesting.

But in short, it is a signal that triggers when breadth improves massively, from a very low reading to a significantly improved reading — during a short period of time.

(Source: Carson Investment Research)

The signal is interesting because it has an impressive track record. It has triggered 20 times since 1943 — putting the S&P 500 higher 6 and 12 months later every time. And it triggered this week.

This doesn’t mean the major indices will run in a straight line up. Also, some of the signals showed only modest gains. So don’t over interpret it.

But it is something.

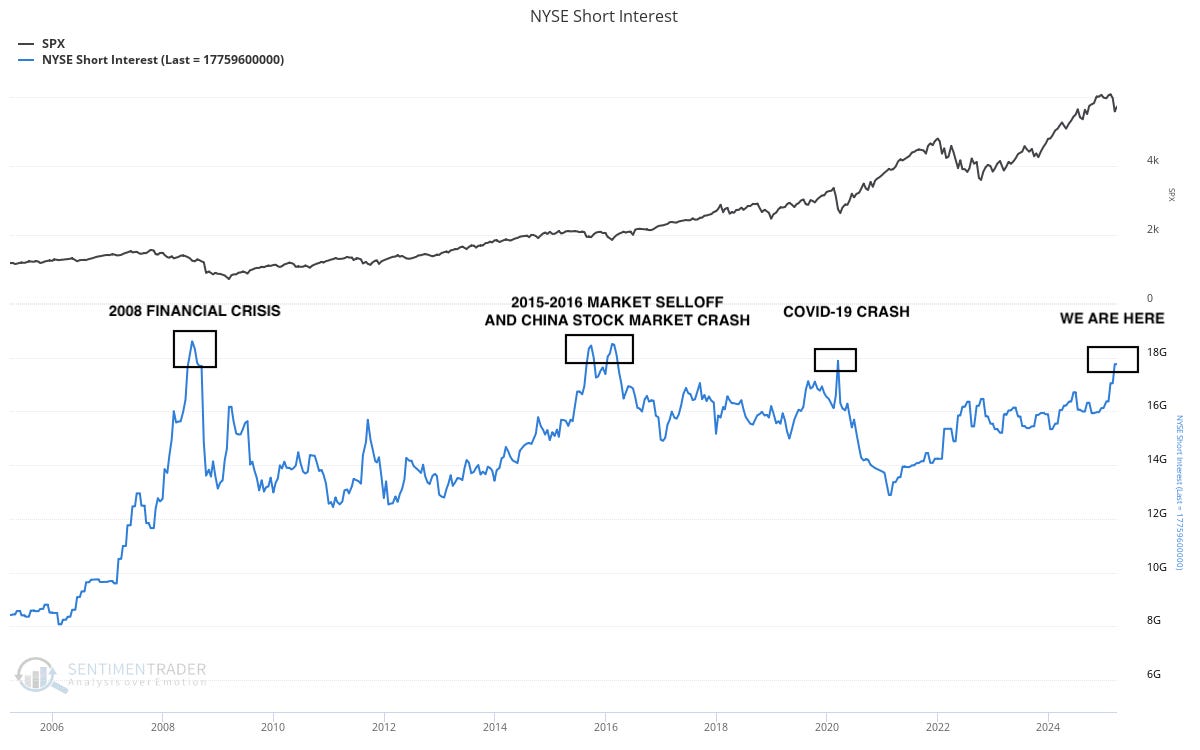

I Said That This Is The Most Hated Rally In Years

It will be heavily shorted, and many will be locked out from it, which only adds fuel to the advance. Actually, it is already heavily shorted.

Looking at the combined short interest on the New York Stock Exchange, short positioning has only been this high three times in the last 20 years.

That is significant. All shorts must eventually be covered. If we can continue the advance, the rally may fuel itself — by shorts covering their losses.

Important to know is that the data is lagging, no data is public yet for the last few weeks. But my guess is that the next reading will likely be higher rather than lower.

(Source: SentimenTrader.com)

A high short interest is widely regarded as a bullish contrarian bet.

Retail Is Shorting Heavily As Well

This chart shows two things:

Small Trader put buying

How much small retail traders are betting on a decline by buying puts. Since retail has a proven track record of bad positioning and trading, a high small trader put buying is bullish for stocks — and it is soaring.

If you compare with the 2022 bear market — you can see that retail heavily shorted almost every time the market formed a significant bottom.

Dumb Money Confidence

Dumb money confidence is a combined indicator, showing small speculator positioning, Rydex index mutual fund flows and other variables — We regard these as dumb money.

We don’t like dumb money buying, but they are not buying at levels that historically have been contrarian bets indicating an imminent decline

(Source: SentimenTrader.com)

I want to highlight that there are several ways to look at dumb money and retail positioning, this is one. On the other hand, we have seen record inflows into leveraged ETFs in this decline, which is retail buying heavily.

VIX Breaking Down And Finally Making A Lower Low

Which is good, it closed at a daily low on Friday and the lowest reading since the beginning of April. We are still however elevated if we want a sustained uptrend. We want it to decrease to under 20, and stay there.

Smart Money Bought The Dip Aggressively

Since our method of trading is largely based on following the smart money footprints, and emulating their actions. We like to look at large commercial hedgers positioning, to get an indication of where we might be heading.

Smart money accumulate stocks when they are confident stock prices will increase. They have a great track record of identifying significant bottoms. But it does not mean they always pick the final bottom.

This chart shows the combined positioning of smart money in the Dow Jones, S&P 500 and Nasdaq 100.

If the value hits a 100, like we recently did, it means smart money have the highest long exposure comparing at least a year back.

(Source: SentimenTrader.com)

Skew Index Showing Decreasing Fear

Skew index is calculated on options contracts in the S&P 500. Showing how options traders are pricing in the risk of a swift and sudden decline, like a black swan event.

It is best used to alert you to be extremely cautious, when it spikes high — like it did in late February, before the decline.

However the more it decreases, the more the risk decreases of a sudden crash — according to smart money. It can however, decrease much further as you can see, looking back at the 2022 bear market low.

You shouldn’t interpret it as if the market can’t decline just because it is low. But seeing it trending down, is still encouraging.

(Source: SentimenTrader.com)

When You Are Reading This You Might Think I Am All In

But I am actually not that bullish at all - yet. There are great underlying potential for a bullish thesis. But there are certainly a lot of bearish signs as well.

But since our trading method will get us out quickly, if this isn’t the turn. We must give bullish action a chance.

Some Last Words About Gold And Bitcoin

After breaking out from a 14 year mega-base, gold has been amazingly strong. It recently climaxed and reversed hard, since it was very overbought.

Monthly chart

Weekly chart

If this is a true change of character in gold, it might form a steeper channel as you can see in the chart. Nevertheless it needs to come down a bit, for us to get involved.

If it can take a breather here, gold miners may setup and soon be ready for a real run.

I am monitoring the best of the miners closely, and will update you when I see any good setups forming.

It Seems Unlikely That Bitcoin Won’t Put In A New ATH Soon

It looks very bullish after backtesting this multiyear base. Looking back, whenever bitcoin put in a big bullish weekly candle like this, it often runs for a while. How bitcoin looks is why I bought MSTR.

They are both volatile, but the potential is there.

How I Will Act Going Forward

I have now bought some stocks — my portfolio exposure is 15%

If stocks continue to act well, and advance or produce bullish continuation patterns — I will increase my positioning next week and going forward.

We are very overbought in the short-term — we will pullback

Don’t panic and don’t choke the trades, as long as they don’t hit logical stop loss levels

If we see bearish reversals in leading stocks, stopping us out, this will force us to cash before a new major decline starts

Don’t overthink or overcomplicate your process

Don’t become overly confident or bullish — we are still in an overall medium and longterm downtrending market

Follow price and the actions of leading stocks — this will ensure you are positioned correctly

Hope this helps and thank you for reading. If you like the content feel free to share it so the substack can grow.

Chart courtesy of Carson Investment Research

Charts courtesy of SentimenTrader.com

https://sentimentrader.com/subscribe-newsletter

Charts courtesy of TradingView

Charts courtesy of TrendSpider

Disclaimer:The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.

Hi. Maybe I missed the entries/posts on the chat or other posts, can you please share positions you mentioned she the post, and when they were posted? Thanks a lot