We Might Have Opened A Window Of Opportunity

But If you don’t handle your trading correctly from here, you are risking ugly surprises. Because we are not completely out of the woods. Today we will go through the trade plan going forward, and the absolute best current stocks that I believe we should focus on.

We Are Not In A Bull Market

Yesterday was the first step, we could easily meltdown from here. Don’t get too eager, wait for the market to prove itself.

Something Was In The Air Yesterday Before The Announcement

I wrote in the chat after the China tariffs news hit, that I was significantly more bullish now than before, if we can hold the recent low. The major indices barely reacted to the worst news that could possibly hit. When the stock market doesn’t react in a bearish way to horrible news - the selling pressure, at least for now, is exhausted. The most realistic explanation to the lack of breakdown on the news, is that the smart money to some degree, already knew about the coming announcement from Trump. That is why we always trade the chart, it is the leading indicator.

Best Trade In Years

When narrative changing news like this hits, the sidelines isn’t the best position anymore like I later wrote in the chat. You need to react without hesitation. I went long QQQ as I wrote in the chat almost immediately. Closed it end of day.

What Happens Now Is Trickier

One of my bullish scenarios in last weeks market analysis, was a fairly quick recovery, at least in the short term.

We Don’t Know What Will Happen Now - And We Don’t Need To Know

This can be a bull trap, a lockout rally that just continues or choppy market that goes sideways forever. The possibilities are endless - don’t over analyze. The price action of the leading stocks will tell the story as we go along. However, I hope the major indices cool down here, and retrace to put in a higher low. That would be the best scenario in my opinion.

Several Of This Weeks Focus Stocks Made Massive Moves

Robinhood Rallied Like There Was No Tomorrow

Up 24% from the MA 200 entry point

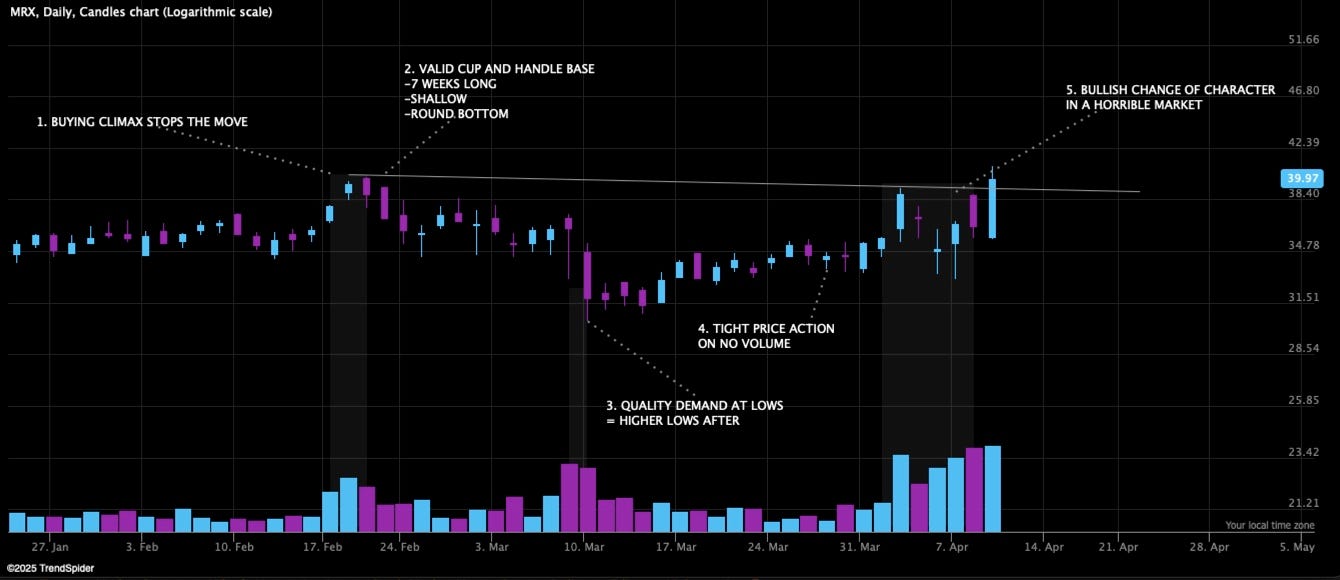

Marex Closing At New All Time High

Two Group Of Stocks Stand Out To Me

I see many possibilities going forward, a lot of leading stocks are at significant pivot levels, and held their 200 day moving average. Lets go through the best of the best, those are the stocks we will focus on going forward.

I still recommend low portfolio exposure, 0-20% depending on your risk tolerance. Apply progressive exposure, buy one or two stocks, if they keep behaving well you progressively increase your overall exposure. That puts you in a strong position and protects you from losing all gains at the same time.

A single 10% trade on a $2k position covers a full year of stock ideas and market insights at The Setup Factory.

Lock in your Early Supporter Lifetime Price - Last Week Of Deal

1. Liquid Leaders

This is why I recommended buying the QQQ. At reversals, money will flow to the most liquid growth stocks, that are a part of major indices. Which we very clearly saw yesterday.

Palantir

One of the strongest stocks yesterday. Building a cup and handle. I hope it will cool down here and act constructively.

Entry #1: On a constructive higher low, stop loss just under that low

Entry #2: Minervini low cheat entry on high volume. Stop loss att the breakout candles low

Robinhood

Still in play if it can digest the gains constructively.

Entry #1: On a constructive higher low, stop loss just under that low

Entry #2: Minervini low cheat entry on high volume. Stop loss at the breakout candles low

2. Cybersecurity Stocks

Outperformed yesterday and was showing great strength. It is also a sector that is minimally affected by tariffs.

Crowdstrike

Entry #1: On a constructive higher low, stop loss just under that low

Entry #2: Minervini low cheat entry on high volume. Stop loss at the breakout candles low

Fortinet

Tesla

I hate to say it, but you can’t ignore Tesla. A lot of people will short it. It is however below the 200 day moving average. If it breaks out decisively with a minervini low cheat entry, it will break above the 200 day and that could be a great entry. I would not buy it at a higher low as the other names, since it is not in a longterm uptrend.

Spotify

I also like Spotify, it has been one of the strongest stocks in this decline. Now only 12% form ATH after a single day of market reversal.

I Have A lot More Stocks Showing Potential

But I recommend keeping it concentrated to the best and most liquid names. They usually outperform initially in big reversals. And most importantly, now is the time to not pay as much attention to the major indices. We will pullback, and we might pullback hard. But if we put in a higher low that would be bullish. And the most important thing going forward, is to monitor how our setups behave, they are leading, not the major indices.

Don’t get too bullish and don’t get too bearish.

Hope this helps and thank you for reading. If you like the content, feel free to share it.

Charts courtesy of TrendSpider

Disclaimer:The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.