The TSF - Focus Stocks Page Will Be Updated Tonight

For all paid subscribers —with the five best setups and opportunities going into this week, complete with methods on how to catch them.

Last week the TSF-focus stocks performed well with 3 out of 5 breaking out, and one stock advancing 15% during the week.

And VNET From The Free The Part Of Tuesdays Post Made A Nice Move

Up 14% On Friday, Lets See If It Can Followthrough Next Week

And Silver Made A Great Followthrough

We bought it early as it was starting to show life.

And it is now following through nicely showing great strength.

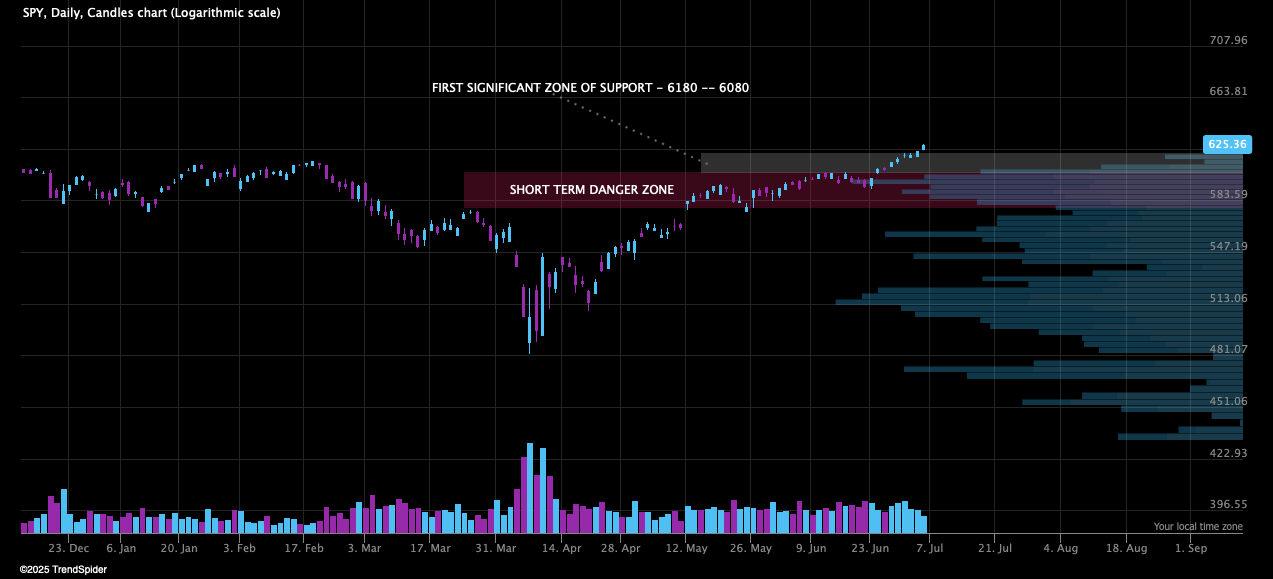

Last Week I Told You That Testing The First Level Of Support Would Be Normal And Likely

And We Tested It And Recovered

And Last Week I Gave You Thoughts On This Complacent Market

The Weekend EU-Tariff Headlines Will Show Us The Risk Sentiment

Either its already is priced in, and the market shrugs its shoulder yet again. Or the complacency finally peaked and we will likely test the breakout level coming week.

We Are Still In A Tricky Market

And the name of the game is fake breakouts, poor followthrough and quick rotations in and out of different groups and themes.

We are cooling off by sector rotation, equity is flowing between different sectors without leaving the equity market. This makes the major indices hold up, but under the hood it is still a stock pickers market.

Where a select group of leading stocks act well, while the broad market experience choppy conditions.

You must have noticed stocks setting up beautifully, only to make a fake break out and reverse hard. Only to run hard the day after — not the ideal environment for swing traders.

This is a choppy market, which can be difficult to navigate, when you are trying entries with tight stops.

But if you have a longer timeframe and are position trading, you will notice that stocks are still drifting up.

And On Friday We Saw A Lot Of Breakdowns

And a selloff in growth stocks and momentum names. Our job today is to search for red flags and make a deep market analysis.

To align us correctly with the market.

Because the best way to produce gains, is to push when the market conditions are in your favor, and protect gains when harder times are coming.

Todays Agenda

A breakdown of the major indices and the levels to watch

Small caps giving us a signal

Important breadth observations

Momentum indicators giving us mixed signals

Smart money hedgers returning to the table

MAGS

Unsustainable levels of complacency approaching

Yields may become a problem

The dynamics of the pain trade has shifted

We need to consider multiple timeframes when assessing market health

Two commodities at buy points

One ETF to buy and one to short

Buckle up!

Celebrating 2,000 Subscribers — 20% Off For Life

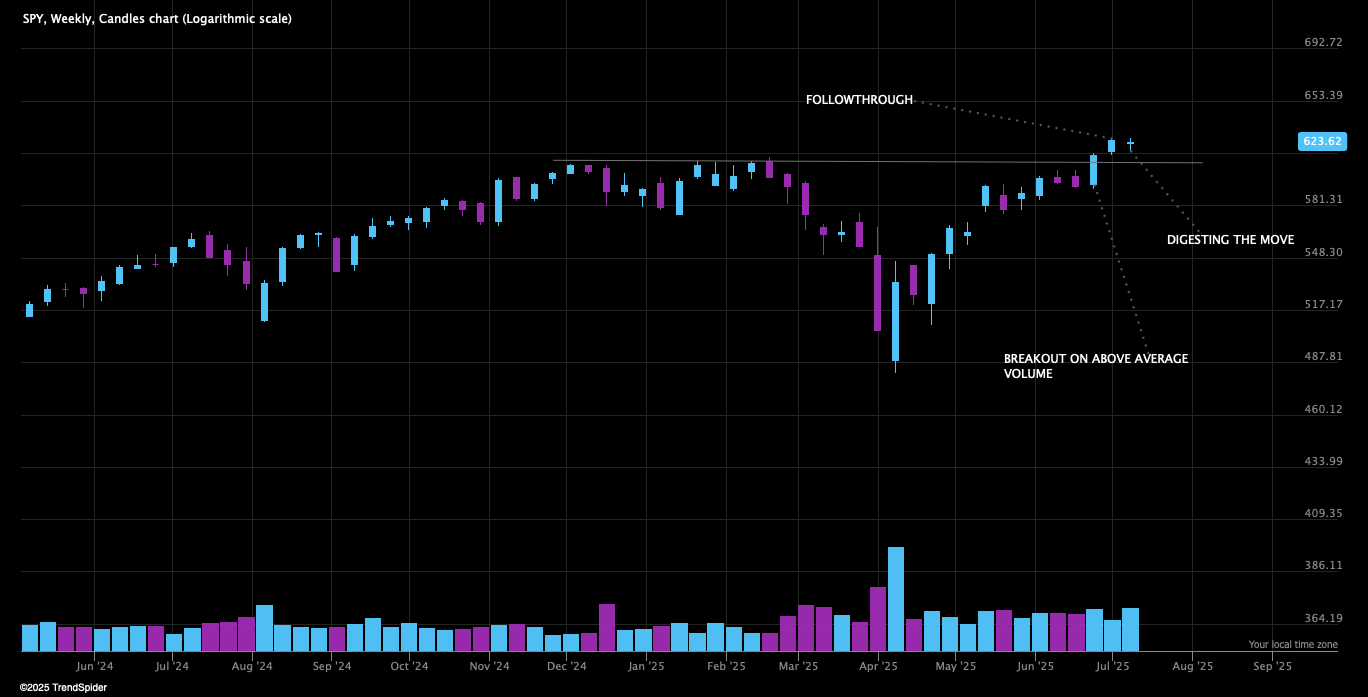

Lets Start With Zooming Out

To filter out the noise.

We saw a healthy breakout with followthrough. Volume can always be better, but looking back at previous breakouts to ATH in the major indices, they are not always on extreme volume.

And we are now quietly digesting the move over the breakout level, which is something we expected.

So far so good.

We Don’t Have To Overcomplicate Things

Since we bottomed we have produced significant higher lows and higher highs. And when we stop doing that, it will be a clear change of character that should make us pay attention.

Stocks and the major indices move in stairs, they produce a big run, consolidate to gather momentum and run again.

And we have now formed a brief consolidation above the breakout level to monitor.

We are above all major moving averages

We found support where we should have

What we still want, is more room away from the breakout level, to diminish the risk of a significant double top scenario

I do not know if we will produce a lengthy consolidation here or not

Since the breakout level is this close, it will likely be tested. Whenever you have a very significant liquidity zone this close, it is almost always tested before the true move comes.

Ideally we will continue swiftly up instead, giving us some room to breath. Otherwise we risk that the next significant pullback, which inevitably will come, will question the entire breakout.

But As You Will Understand After Reading This Analysis — A Move Like This Would Be Normal And Likely

Longterm Breadth Still Improving

Last week I showed you the followthrough breadth thrust we were looking for, that confirmed the strength in the major indices.

We entered the week overbought and were expecting a pause or sector rotation to cool off — which is what happened.

This week breadth continues to improve and is producing higher lows and higher highs, which is exactly what we want to see.

And if we look at NYSE stocks above 200 day moving average, we actually see a bullish divergence, where breadth put in a higher high on Friday, while the major indices declined = bullish in the longer term perspective.

If We Start To Hesitate Here There Are Alot Of Room On The Downside

Because we are still pretty overbought looking at medium term breadth. Combining that, with the presence of very few lengthy bases in leading stocks, favors a continued choppy market in individual stocks, where we are cast between euphoria and despair.

% Stocks Above 50 Day Moving Average

We are at levels of overbought where it is normal to decline.

It is necessary to pause or decline, to produce healthy bases that can fuel a sustainable advance up. This is what we want, because stocks trend better from base breakouts.

Otherwise we are likely to see more boom and bust moves, which is unfavorable for our trend following strategy.

Small Caps Meeting Significant Resistance — Favors A Consolidation

Small caps have had an amazing time, leading the market, exactly what we want to see.

Russell 2000 reclaimed the 200 day moving average and followed through. It is however meeting significant resistance here, which will likely produce a consolidation.

We Are Losing Momentum While Breadth Is Improving

Which also favors a further consolidation. It is very obvious that we are losing momentum when looking at the McClellan oscillator.

The McClellan oscillator is a breadth momentum indicator showing us the underlying momentum in the market.

We are now in neutral territory.

(Source: SentimenTrader.com)

This also verifies what we see in the market, lagging stocks breaking out at the end of the thrust up.

But the fact that breadth is not crashing, while we are losing significant momentum is very bullish.

Smart Money Buying Again

Hedgers combo show us hedgers activity in the major indices. They are regarded as smart money, and thus a non-contrarian signal. When they are bullish, we want to be bullish as well.

They got aggressively long in the thrust up from the bottom. We then saw them sell this last rip into ATH.

And they have now started increasing their buying activity again, which is positive.

Because when we look at their behavior after the 2022 bear market, we see them being extremely skeptical after the initial reversal.

Compared to that they now seem to have much more confident, and returned to the buying fairly quickly which is bullish.

We want them however to followthrough on their buying, to gain more confidence in the signal.

(Source: SentimenTrader.com)

MAGS Finally Did It

And reclaimed its longterm uptrend channel. Lets hope it sticks.