I Have A lot Of Swing Trading Ideas To Share Today

While the market has been tanking, I have been turning every stone for a month, for stocks unaffected by tariffs that are setting up. I will share some of them with you today. But first lets go through what happened yesterday, and what we can expect going forward. We will put together a trade plan, to know when it is time to push.

Yesterday Was One For The History Books

Megacaps traded like pennystocks and the S&P 500 had an intraday range of almost 10%. You don’t see this in a healthy market. Oversold moves, are never healthy moves.

Going Into This Week My Main Scenario Was That We Would Test The Market Top Of The 2022 Bear Market

That we did immediately, which is good. Hitting major liquidity and support zones, is the start to understand where we are heading.

A single 10% trade on a $2k position covers a full year of stock ideas and market insights at The Setup Factory.

Lock in your Early Supporter Lifetime Price - Last Week of Deal

Yesterdays Move Was A Start - But Don’t Overinterpret It

I am the first to turn bull when we get a sign, because I love bull markets. I also love not losing money, that is why we have to kill our confirmation bias. Have patience and await proper confirmation of a reversal.

It Played Out Like My Scenario - Now What?

This was an oversold move, it was expected. Now we need the market to confirm yesterdays reaction. It’s nice looking at breadth indicators, but to visually understand oversold conditions, let’s look at the whole decline of the S&P 500, from the end of February in a lower timeframe.

The S&P 500 found support in the longterm decline channel floor. Adding to the strength, is the major liquidity zone of the previous market top. If the S&P500 wouldn’t at least react at this level, then we would certainly be extremely worried.

How Do We Confirm The Reversal?

The good thing is that we now have a new low to play against. How price reacts at this low, and at the top of the range, will give clues of where we are heading. Since I like bull markets, here is a bullish scenario, but anything can happen as you understand.

You Do Not Have To Enter At The First Green Candle

If this is the start of a bull market, there will be plenty of opportunities. It is very hard to not get FOMO. And these types of declines often produce locked out rallies. Meaning the stocks just rally without a setup because they are oversold, and it is hard to get in, because there isn’t a low risk proper setup. And the stocks just keep on rallying. This is unhealthy rallies that often end with a rug-pull.

What I Liked With Yesterdays Action

The stock market ignored negative news for the first time in a while. This is an encouraging sign. The additional China tariff news did not lead to a meltdown. That is a bullish clue.

What I Disliked With Yesterdays Action

Still no panic, volatility but no panic, many bought the dip. But more importantly, VIX closed higher yesterday. We need it to crash. In a bear market, VIX can stay elevated for a long time. But we want it to at least bleed a little on bullish moves. Something to keep an eye on.

Four Groups Of Stocks That Should Outperform In A Tariff Environment

Tariffs will affect all companies in some way, and if it leads to a recession it most certainly will. Risk appetite decrease affecting all stocks initially. But when the dust settles, and the extreme volatility decrease. We will see the leading groups emerge and setting up.

Software - Cloud - Cybersecurity Stocks

These should outperform because they are generally minimally affected by tariffs. They are also typical growth stocks that institutions like

Recession Stocks With Minimal Exposure To Tariff Countries

There are a couple, holding up very well. Recession stocks are typically low priced stores and defensive stocks within finance and insurance

Some Healthcare - Software Healthcare Stocks

Are minimally affected by tariffs and should outperform

Liquid Leaders

In uncertain times, money will flow to the most liquid large caps with stable businesses, even if they are affected by tariffs

Lets look at the stocks I see setting up. Some of them are old cases, but they are simply the ones that are behaving the best. There are generally very little setups at the moment, and I don’t want to give you weak stocks and setups. Lets focus on the best.

1. Marex Group PLC (Ticker: MRX)

Financial services platform, market maker for energy, commodities and the stock market. Based in UK. Good earnings and sales growth. Profitable.

Daily chart

Weekly chart

2. Dollar General (Ticker: DG)

Low-priced store, recession play. Extreme strength during the decline, with fundamental turnaround story. Minimal exposure to tariffs about 10% of earnings. Turning around from a massive cup base. A tight handle developing now would be optimal.

2. Ezcorp Inc. (Ticker: EZPW)

Leading provider of pawn shop transactions. Minimal exposure to tariffs, mostly second hand products.

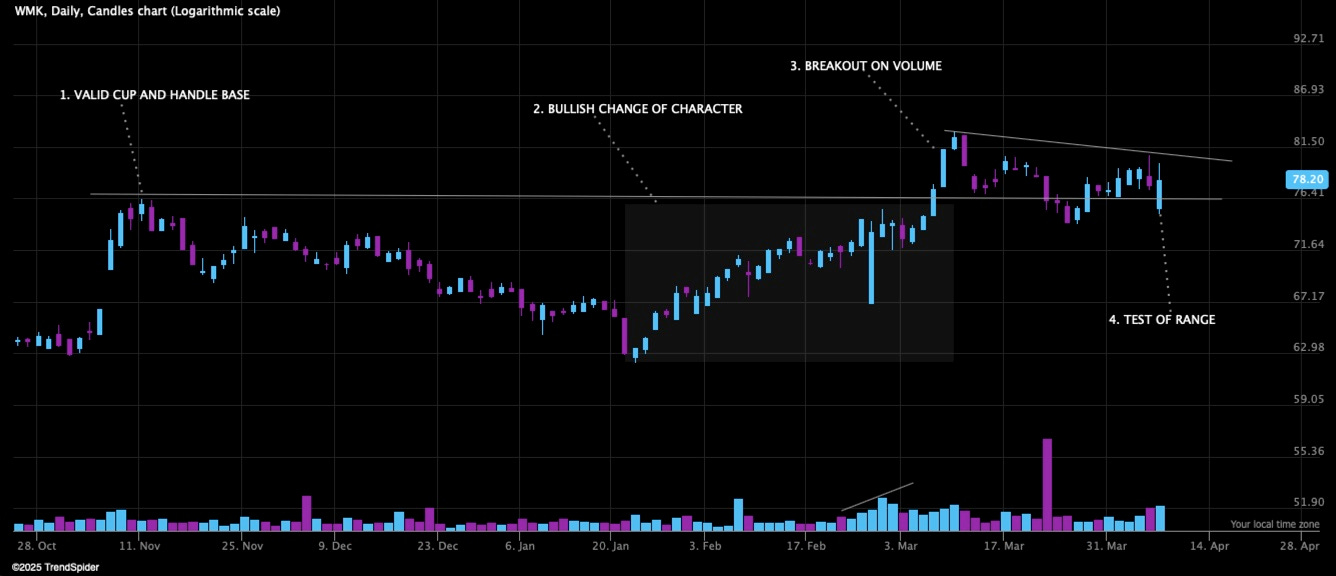

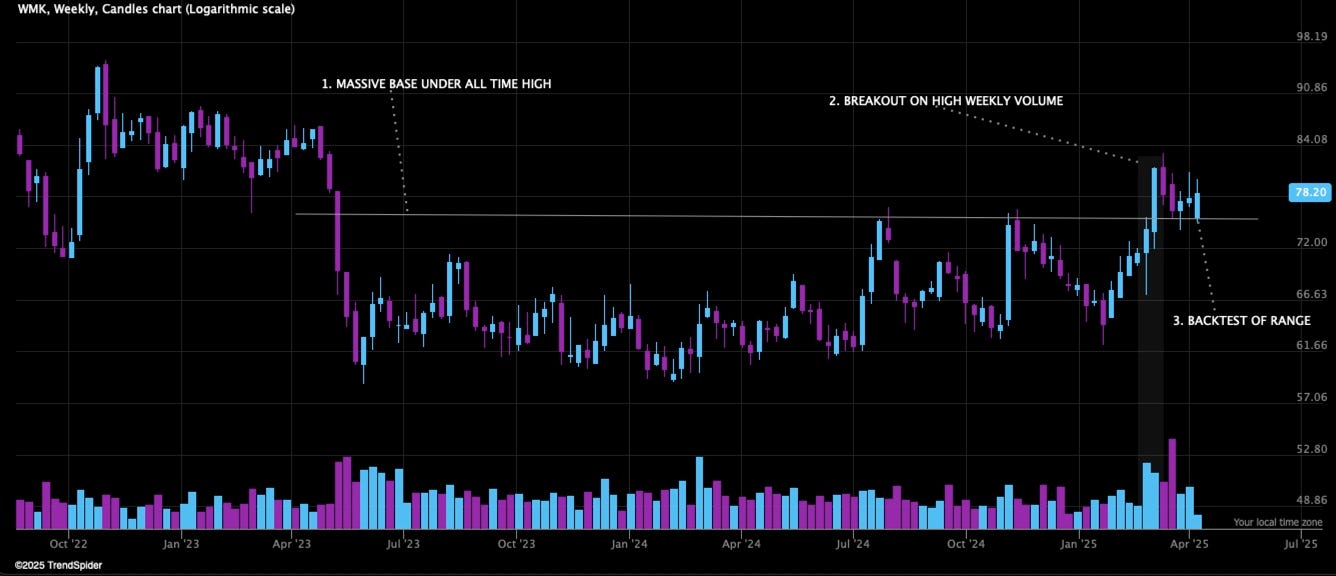

3. Weis Markets Inc. (Ticker: WMK)

Supermarket chain, mostly imports from Mexico and Canada, currently not affected by tariffs. Acceptable liquidity in the stock but in the lower range.

Daily chart

Weekly chart

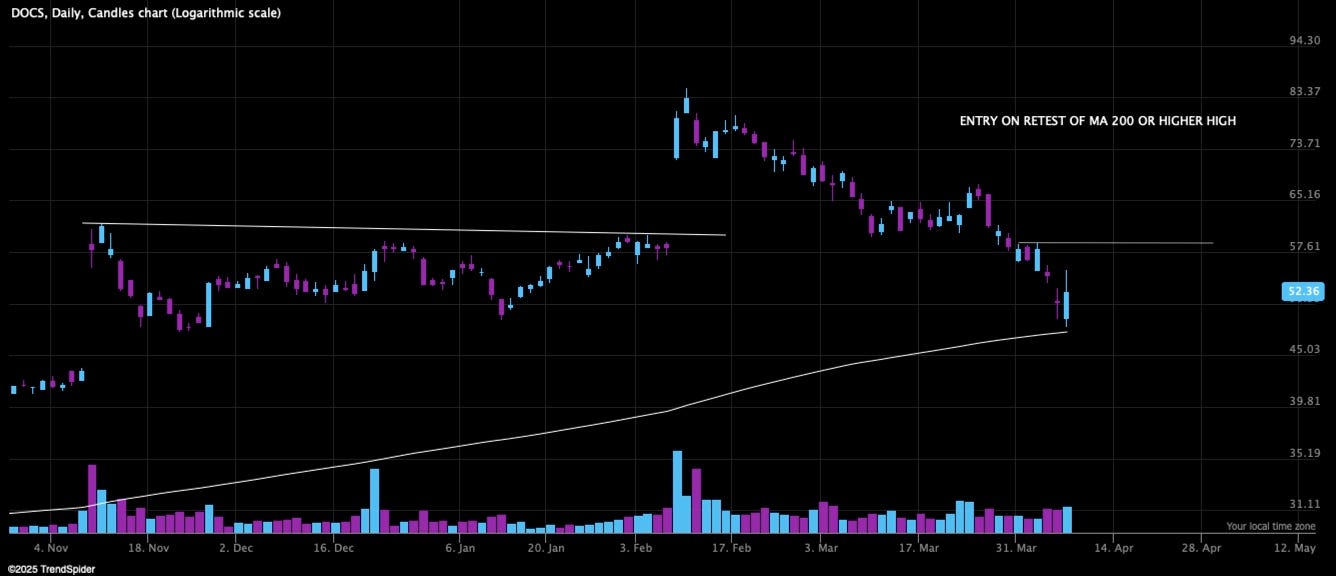

There Are Some Bounce Plays In Past Leaders

Breakouts work bad in this environment. Bounce plays can work better. Here are some interesting charts in past leaders meeting MA 200.

Doximity (Ticker: DOCS)

Robinhood Markets Inc. (Ticker: HOOD)

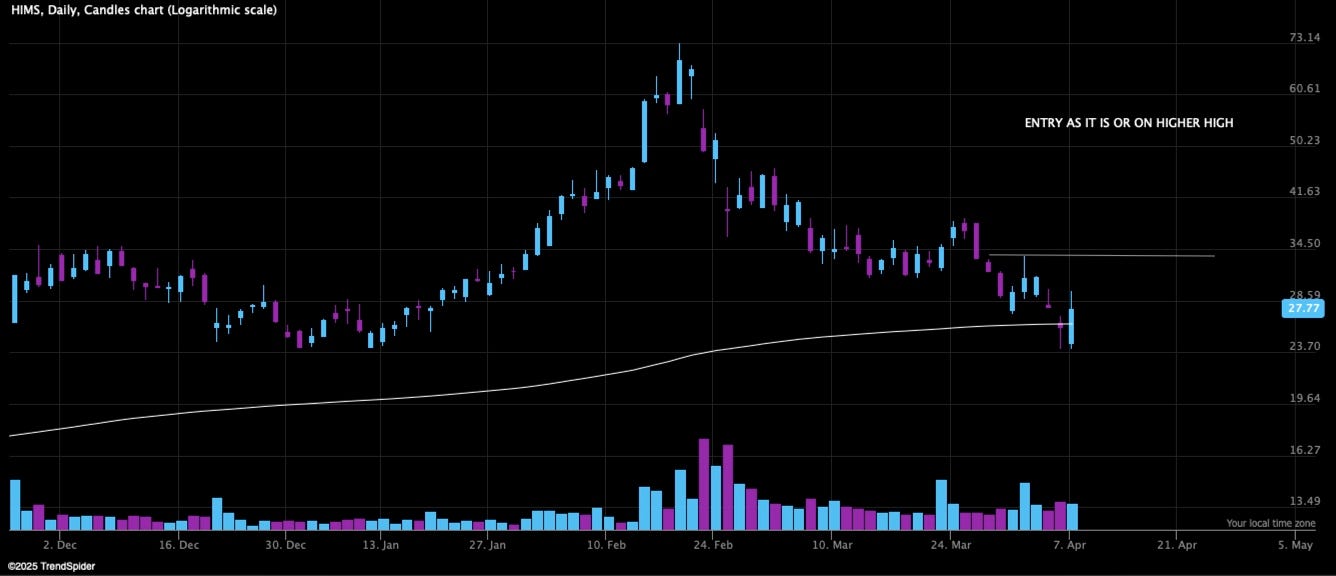

Hims & Hers Inc. (Ticker: HIMS)

Daily chart

The Bottomline

This is not a market for breakout trading

I recommend 100% cash or minimal exposure, at least for a couple of days until the market settles

Yes, that way you might miss the initial rally. But the gap down risk day-to-day at the moment is very high

But I want to provide opportunities for all, since everyones trading style, timeframe and risk tolerance differ.

Hope this helps and thank you for reading. If you like the content feel free to share it.

Charts courtesy of TrendSpider

Disclaimer: The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.