The TSF - Focus Stocks Page Will Be Updated Tonight

For all paid subscribers — with the five best setups and opportunities going into this week, complete with methods on how to catch them.

Last Weeks Market Analysis Is Now Open For All To Read

War, Yields, Tariffs And Powell

My core message today is to block out the noise. We made incredible gains last week. On the week with peak uncertainty if you read the news, as well as FOMC and OPEX.

Don’t misinterpret me, this is a treacherous market environment that should be traded carefully, with vigilance and focusing on a few select leading stocks — we are not in a 100% portfolio exposure market.

War escalation during the weekend, is putting pressure on futures going into Monday — which makes it even more important to block out the noise. Because the news flow will be heavy and ominous.

Watch the charts, they have all of the information that you need. If they signal fear — we will be out in a day or two.

Last Week I Told You

And Showed You The Chart Above Of Very Short Term Breadth

And This Week We Saw A Great Breadth Divergence

While the major indices declined, we saw very short term breadth improve at logical levels seen in normal declines.

This is great and favors that this will not turn into something ugly in the short term — but things can change quickly with the escalation of the war.

Going into this week, we want to see very short term breadth hold up and respect the level of oversold seen in previous normal declines.

Last Week I Also Showed You This Chart And Shared My Thoughts On Where We Could Be Heading

We expected a pullback and were positioned accordingly in select stocks with reduced portfolio exposure.

We Have Declined Close To The 5900 Level — What Now?

So far things are unfolding as expected — we are declining in an orderly manner into the most significant support zone — around 5900

We are now testing EMA 21 which is normal, since it hasn’t been tested in several weeks. It is normal with shakeouts below EMA 21 — I expect us to shakeout below it into the 5900 support zone this week

What happens on that test will be important

If this zone of support fails, we dive into the more worrisome scenario and test the 200 day moving average — our last significant support

But I Am Much Less Worried Than Last Week

Because our stocks are showing no fear and they are making meaningful advance. Our core positions are advancing significantly.

While the major indices are making new lows, our focus stocks are making new highs.

This is usually an indication that we are not headed for a serious decline. Things can change quickly, and our philosophy is to stay nimble, but that’s where we stand after Fridays close.

We will quickly find out if the escalation of war changes this, or if its already priced in and the dip is bought.

As long as we stay above the 200 day moving average, and leadings stocks are acting well — I pay very little attention to what the major indices are doing.

Let the price action in individual stocks decide your exposure.

Today’s Agenda

We will dive under the hood and look for clues that can help us position ourselves correctly

Breadth observations and divergences

Small caps flashing our favorite clue

VIX at crossroads

MAGS

Hedge fund positioning

Smart money options positioning with a great clue

Retail positioning with a positive trend

Money managers still skeptical

Seasonality matters?

Gold

One ETF setting up

Tradeplan for the TSF-community

Buckle up!

Medium Term Breadth Cooling Off In An Orderly Manner

Last week I told you that medium term breadth needs to cool off, so that we can get a new thrust up in longterm breadth readings.

As long as we are oversold in the medium term, stocks are more likely to build bases and consolidate.

We are seeing a cool off that is very orderly, which I like.

Nasdaq Composite Stocks Above The 50 Day Moving Average

Things can always escalate, but so far we see no aggression in this decline, which is verified by leading stocks acting great while it is occurring.

If You Squint You Will See The Breadth Divergence

A really bullish sign if it continues and becomes clearer.

While the S&P 500 is making new lows, stocks above the 200 day moving average are holding up.

This is a breadth divergence, and a sign of an underlying strength in the market. We need this to continue.

As I have said before, we need a longterm breadth thrust propelling more stocks above the 200 day moving average to confirm the overall reversal.

% Of Stocks Above The 200 Day Moving Average Compared To S&P 500

This might be an early clue, and we need much more power in long term breadth to get comfortable.

Small Caps Still Ahead Of The Market

Bottoming before the S&P 500 and clearly outperforming during last week — a bullish sign.

Russell 2000 And RS-Line Comparing Performance With The S&P 500

What we want to see now is a reclaim of the 200 day moving average for small caps. If small caps reclaim their longterm uptrend, this would be a great signal and increase the chance of this developing into a meaningful bull market.

VIX Meeting Resistance

Of its downtrend, which is good. But It looks a little too bullish. Watch it closely, if it starts living above 20 — that would be a warning sign to carefully consider

MAGS About To Break Down

Looking worse and worse for every week I show it to you.

Will we get a market where small caps thrive and tech-mega caps get hammered? I have no idea, but MAGS need to catch a bid very soon, because otherwise it will drag the S&P 500 into a new bear market.

Don’t forget that MAGS is more than 1/3 of the S&P 500.

Hedge Funds Still Underexposed To Equities

Which is good, this means that buying pressure may come in on a dip. A market making highs with hedge funds overexposed to equities is bearish. Because the potential outflow from stocks will put further pressure on prices.

We want to see hedge funds underexposed — so they can buy and support prices on a decline.

(Source: SentimenTrader.com)

Since hedge funds are smart money, if we see them becoming overly bearish equities, that would conversely become a warning sign of a more significant decline.

But we are not there yet, we will follow their moves closely.

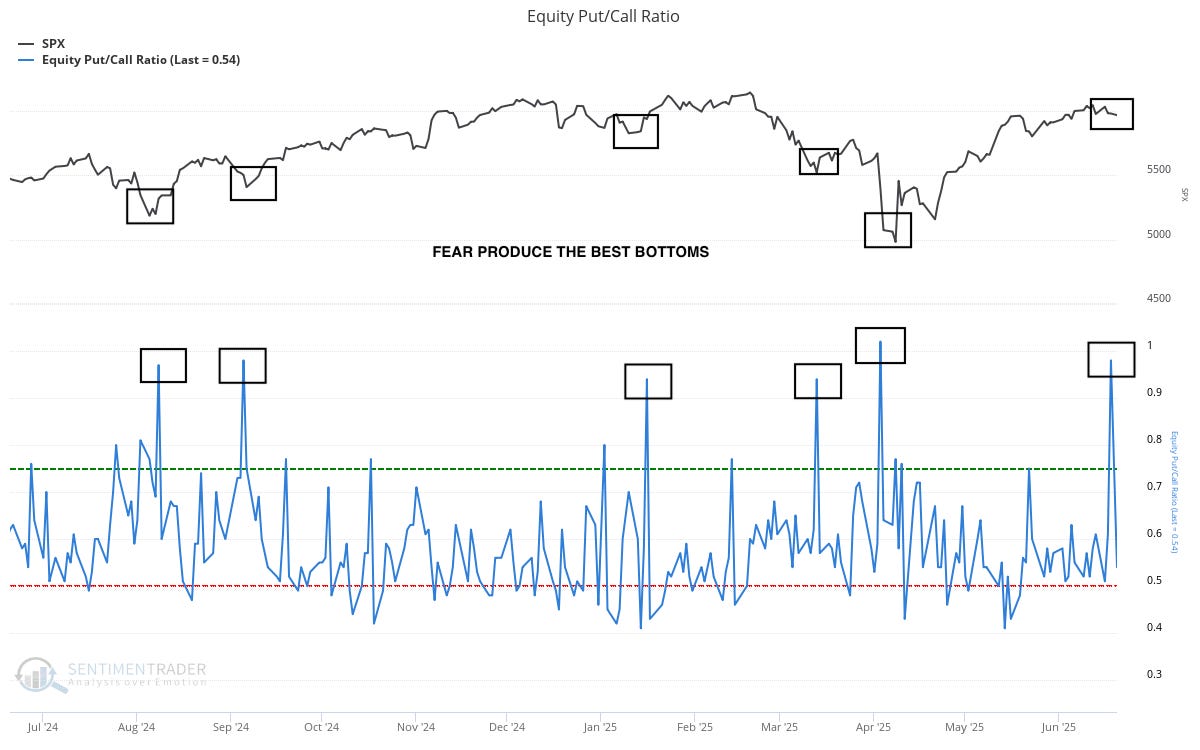

We Got Real Fear In Equity Put/Call

A bullish sign. We got a great spike in equity put/call this week. The type of level of fear that almost always corresponds with an at least temporary bottom.

(Source: SentimenTrader.com)

It spiked to 0.98, which is just slightly below the reading of 1.02 that we put in the bear market bottom.

Fear is good, and the market is much more likely to advance after significant fear and hedging activity like this.

Retail Is Cooling Off And Money Managers Remain Skeptical

Which is great. The market will most likely move in the direction of the maximum pain. Retail is continuing too cool off with dumb money confidence decreasing.

At the same time AAII bulls are still at low levels and decreasing. Low AAII bulls is a contrarian indicator — when money managers are skeptical, the market is more likely to continue to advance.

They are not at an extremely bearish reading, but the combination of the two observations still make it interesting.

(Source: SentimenTrader.com)

The more people are becoming bearish, the more likely it is that we will advance.

If History Repeats Itself Hold The Pain One More Week And Wait For The Rip Up

Because the last week of June is a very weak period. And July is one of the greatest.

(Source: SentimenTrader.com)

The Bottomline

I sound extremely bullish — I am not

I am as always nimble, trying to stay emotionless and watching the stocks I am holding for clues

But I see more bullish signs under the hood this week than last week

But since reviewing the market, the war has escalated and we will easily spot if that is priced in our not. If its not, we will see sharp bearish reversals in leading stocks breaking key levels. A cue for us to go to cash.

But if leading stocks continue to act well — we must remain focused on the bullish thesis until that changes

VIX is still elevated, the next step to confirm what I am seeing in individual stocks, is that we want to see VIX declining

Studying all sectors and industry groups we don’t see signs of us limiting up from here — most sectors are at significant resistance and need to cool off and muster power for the next advance.

Expect choppy consolidation in the near time

I still believe 2025 is the year of the chop, and that we will consolidate here for a while before choosing direction

But stocks are setting up, breaking out, holding key levels. Thats all the signs you need to participate in the market — but things can change quickly

This is still a stock pickers, theme driven market where gains are short-lived

Lock down profits when you have them, respect your stop losses, but don’t be too afraid to participate

This is still not a 100% portfolio exposure market

Lastly Gold And XAR

Gold is looking interesting if it can hold here, providing a low risk entry point for a larger move, if you have a longer timeframe this can be a good spot.

Of All ETFs I Think XAR Is Looking The Best

Defense giving us a second chance here. I already posted about it when it broke out the first time.

It is now making a tight pause in its new uptrend.

Hope this helps and thank you for reading, if you liked it feel free to share it.

Charts courtesy of SentimenTrader.com

https://sentimentrader.com/subscribe-newsletter

Charts courtesy of TradingView

Charts courtesy of TrendSpider

Disclaimer:The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.

Did i miss TSf stocks for this week