How This Publication Is Structured — For Those That Are New

Sundays:

Deep Market Analysis

TSF - Focus Stocks Page Updated— 5 core setups, the best I see in the market, updated every Sunday

Tuesdays: This post — More setups, new emerging leading groups and themes, adapting to what is unfolding in the market

Thursdays: More setups that have developed during the week/trading educational posts/deep dives on single stocks

Everyday pre-market in the chat: Highlighting what is happening in the market, list of stocks to watch everyday that didn’t fit in the posts.

We Are In A Buy The Dip Environment

Until the dip stops being bought. This is a core message I have conveyed to you during the last 1-2 months. And the pattern continues, which is encouraging.

It will also be very easy to spot real fear and bearish change of character. Because so far every key level in all leading stocks, have held week after week.

The tariff news are picking up again, we do as we always do, focus on the charts and ignore the noise.

The charts will tell us to get out, long before the news hits.

When We Had The Aggressive Sector Rotation Last Week

I told you rotations can be brief, and I personally focus on stalking key leading stocks as they decline — because they can produce great buy points in a buy the dip environment.

Instead of drifting toward trading defensive stocks, catching a bid in a shorter timeframe.

Our main targets are growth stocks — since they produce the largest gains in a bull market.

Tech/Semis/Software Resilient

And giving back very little so far. We are seeing a broadening of the rally, without significant weakness in the prior leading groups. Which is what we want to see in an emerging bull market.

I Recommend Tracking ARKK

Because it is a great piece of the puzzle, when assessing the overall risk apetite.

It has performed well and is up 15% since our entry suggestion.

The Goal Is That At Least One Of The TSF- Focus Stocks Breaks Out As Soon As Possible Every Week

If they do, I am doing my job. And that is what usually happens.

The TSF — Focus stocks page shows you five core setups in leading stocks every week, with methods on how to catch them.

For those that don’t have the time to track alot of stocks, and want to limit their world to the best setups, and focus only on a few stocks.

RKLB Didn’t Disappoint And Broke Out Immediately

It gapped up, closed the gap and tested supply. Putting in a higher low before breaking out. Up 9% on good volume.

And Happy To See That Uber Finally Broke Out

It has been a difficult stock, whipping a lot of people around. But lately it really looked ready to go.

Highlighted As A Top Setup To Watch Last Week

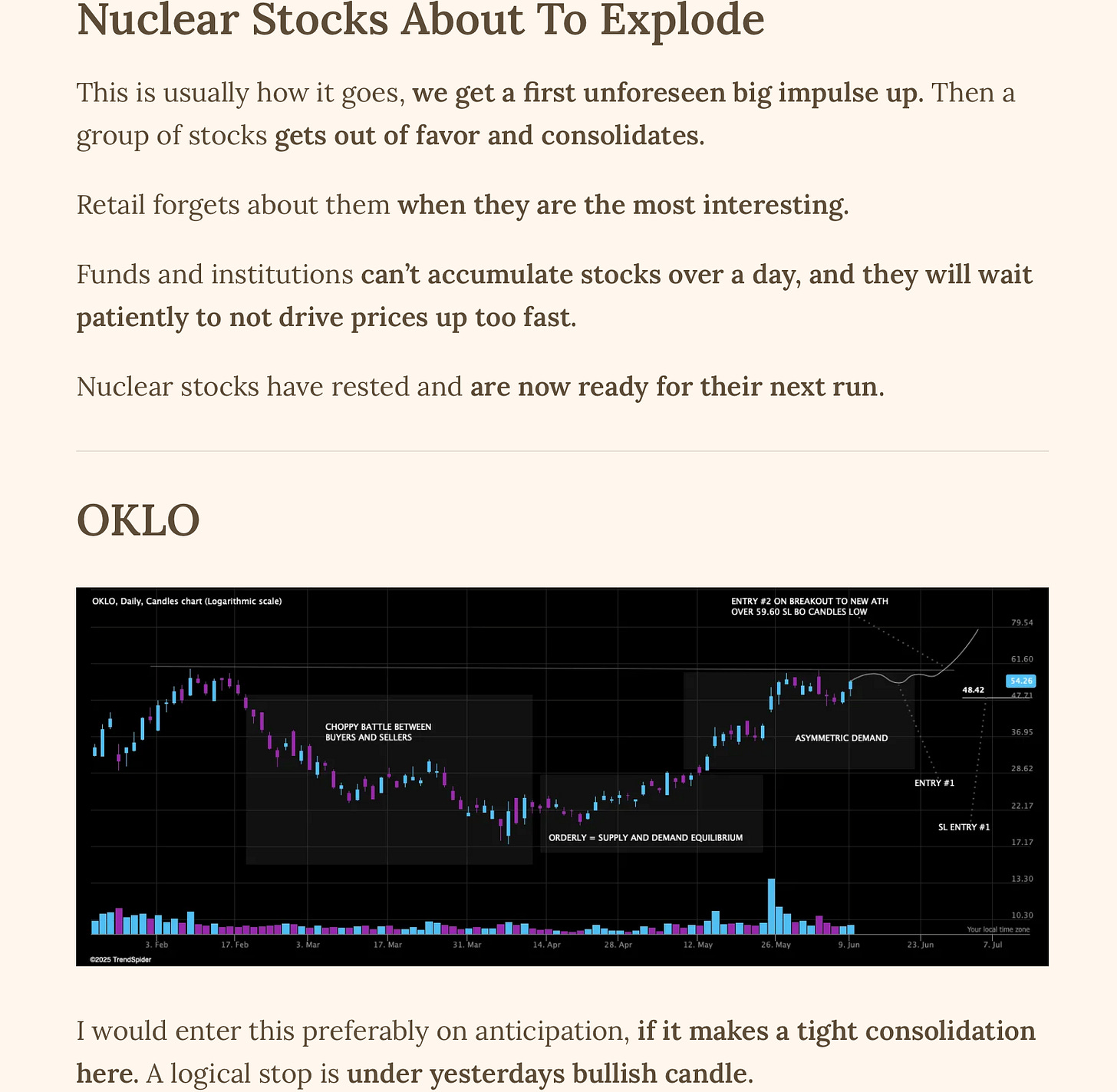

And Lastly Before We Start — Don’t Miss The Next Run In Nuclear

We already captured the first explosive moves when OKLO and SMR ran 30-40% in days.

They Are Looking Ready And I Highlighted In The Chat Pre-Market Yesterday To Watch Them

The second run is always more difficult to buy, and we often get shakeouts. I am not sure they will limit up from here, but this can be the start of a nice consolidation to watch closely going forward.

Today We Are Going To Do Two Things

Look at some setups in fresh names.

And I also want to highlight two groups of stocks/themes changing character.

We noticed the semiconductors gaining traction early several months ago — that resulted in an amazing run for us, from the lows to new ATHs.

This might be the start of something similar.

VNET Is About To Go

As you know I practically don’t trade any Chinese based stocks. Because of the political and regulatory risks. This is the third Chinese stock setup in more than 4 months of this substack being active. But its a really nice setup.

VNET operates more than 50 data centers with tight collaborations with Microsoft, Adobe and Alibaba.

It is within the most bullish theme, and is showing all the hallmarks of a stock about to break out soon.

The Chinese stocks overall, might be up to something soon. But this is not the new emerging groups of stocks I want to highlight today — they are coming further down.

MCHI

ONON

I have watched ONON for a long time, because it bottomed with immense power.

Great revenue growth and impressive EPS growth

Profitable

After it bottomed, it gapped up on high volume on earnings. Gave it all back, and is now finally shaping up again.

Since it can waste our time here if this is not the real thing, focus on buying strength — but I wanted to show it to you early.

NTNX

Super interesting company fundamentally. Cloud infrastructure provider, SaaS model. AI-beneficiary.

Accelerating revenue growth

Impressive EPS growth

Profitable

Financially stable

Also a stock I have been following for a long time. After we bottomed it outperformed the market gaining over 50%, after that it has been lagging. But since it outperformed before that, it can be normal.

Very nice consolidation after putting in a higher low. It can be entered on anticipation, but the same with ONON. It might waste our time if this is not the real move.

I would prefer entering this on strength, but its giving us a great entry on anticipation here with a good stop. I also wanted to show it to you early so you can track it.