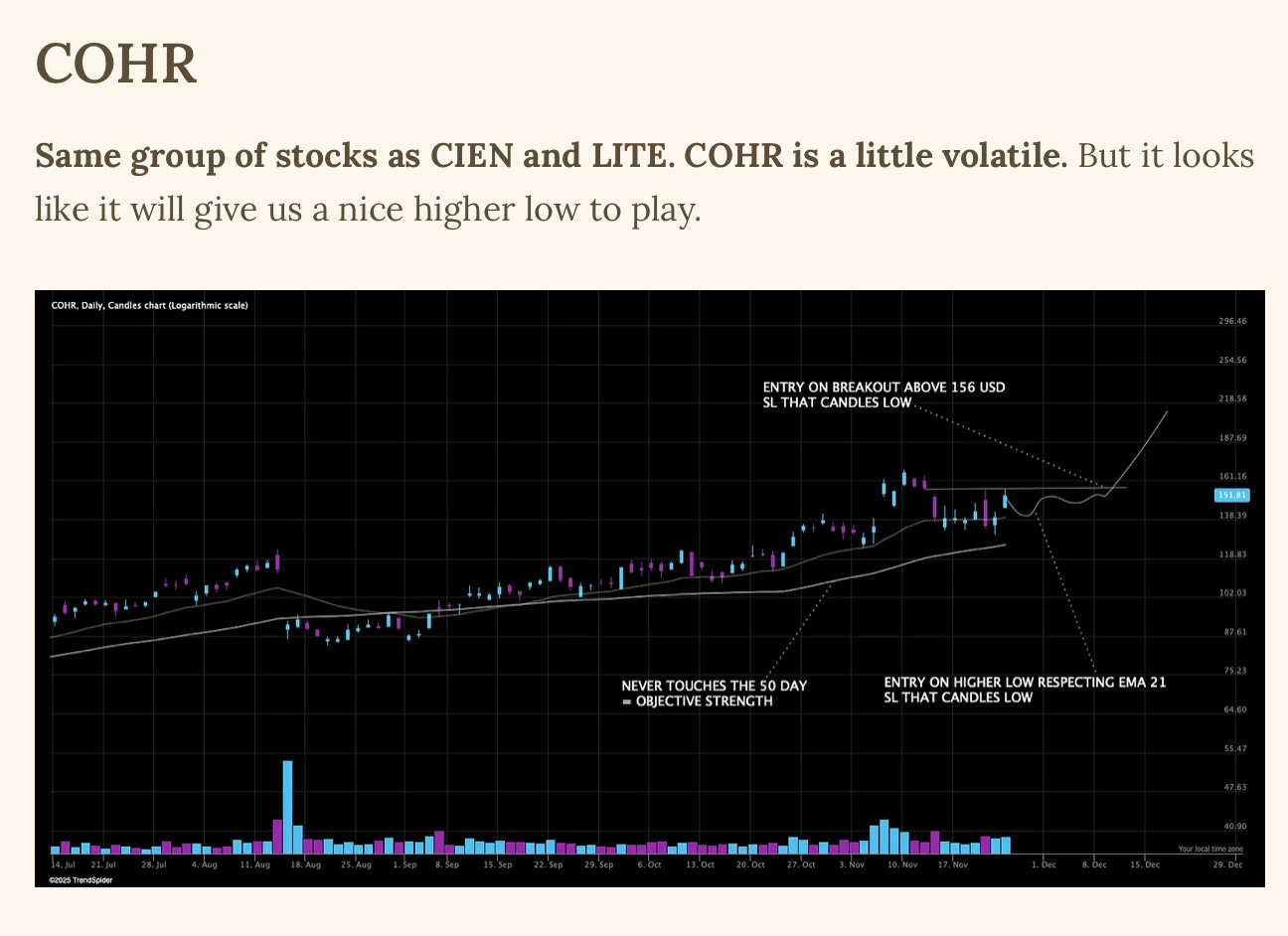

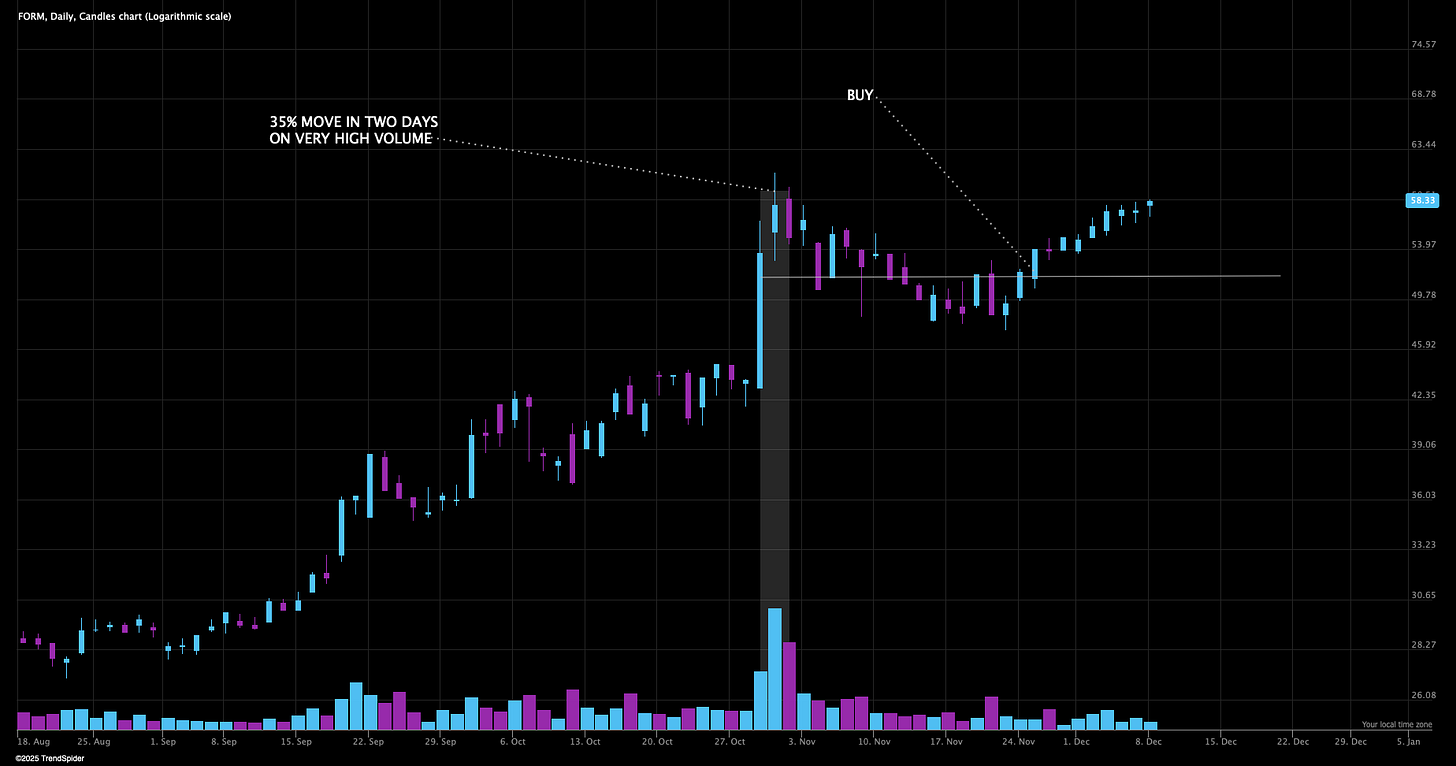

Before We Start Lets Admire COHR & FORM

Because they are trending relentlessly. Both recent setups, and I hope some of you caught the moves.

Up A Quick 30%

Trending nicely no doubt.

Lastly ALAB Seem To Be Following Our Roadmap

After a little detour that screwed everyone.

We mapped out ALABs future on October 23 in one of our educational posts.

It followed the path we laid out very nicely. And it was also a recent setup, buying the breakout above the downtrend.

The unexpected breakout after a total crash. That was a hard catch.

But it might start to get interesting here, I’m watching closely.

Today We Will Dive Deep Into One Of The Most Important Topics

TSF — members know by now how most of my buys look like. I like sniper entries in low risk spots, when most people are closer to selling.

Because I like to be positioned before the breakout with low risk — it puts you in a very powerful position from the start. And it gives you the option to sell into the crowd, that’s chasing a breakout that might fail.

And today we will go through all of my playbook on how to buy pullbacks and EMA 21 plays. I will break down when to use the setup, in what stocks, what to look for when assessing the potential of the setup. And I will give you several ways of execution. No vague information — this is a useful handbook that contains everything you need.

And we will also talk about moving averages, when they work and when they are noise — because you should not buy all pullbacks to key moving averages, and you have to know how to buy them.

And lastly we will go through my absolute favorite setup — the failed breakout. An overlooked high potential low risk entry tactic.

Understanding and using the failed breakout setup, is one of the most powerful entries you can learn, when used correctly.

As You Join Us You Get Access To Our Trading Knowledge Resources

All posts can be found under the trading knowledge tab on our homepage, linked below.

And I recommend all paid members of TSF to have a look at these, I put in a lot of work in them. Every post took days to complete.

And I always try to make them as useful as possible for you. This is also why we TSF never do free trials — too much value and hard work embedded in the archive.

Content:

TSF - Guide Of The Wyckoff Concepts Of Accumulation, Distribution And Test Of Supply

TSF - Guide For Mastering Stop Loss Placement & Assessing Extension

TSF - Guide To Buying Earnings Gaps & Powerful Gap Ups

TSF - Risk Management & Position Sizing Guide

TSF - Guide For Buying Breakouts

TSF - Guide On How To Handle Swing And Position Trades

TSF - Guide On How To Use Volume By Price

TSF - 10 Core Concepts To Develop A Profitable Trading Framework And Process

TSF - Guide For Mastering The Minervini Low Cheat

It’s getting comprehensive, but I still have many topics I want to cover and we will add them as we go along.

Before reading this post, I recommend going through our educational post on the timeless principles of accumulation, distribution and test of supply — these are key basic concepts every trader must understand.

And to learn how to buy pullbacks, you need to understand what a logical stop loss is, and how and why you must pay attention to extension in stocks.

This is a long one, grab a coffee and lets go.