I Post About A Lot of Setups — So I’ve Made Navigation Easier

There’s now a new tab on the homepage, where I highlight what I consider to be, the 5 best setups and opportunities in the current market. This list is updated every weekend.

Before We Start Lets Have A Look At Our New Position

We bought ServiceTitan (TTAN), after it tested the IPO-range and recovered. When supply is exhausted, stocks are usually ready to go. Up 10% in two days on good volume.

This is a stock you should monitor for a long time going forward — it was one of the first stocks to breakout as the market bottomed.

And HOOD Finally Broke Out

Which we own and added to as it moved. HOOD produced a very similar setup. After a bearish reversal, it tested supply, breaching the past low. The test was bought, which was the signal that the stock was ready to go.

From the subscriber chat earlier in the week

You will see the same thing happening over and over again. But it only works if you have read the price action in the whole previous range correctly.

Focus on finding leading stocks at an inflection point — where a significant asymmetry between supply and demand is imminent.

Last Week I Told You

And Showed You This Chart

The Market Chose Confusion

Hopefully we will not remain in confusion as long as my scenario from last week — but the market is clearly in indecision

If we get a bearish rejection from here, a retrace to 5500-5400 level is our first stop. This is a very significant support zone, that must hold for the short-term bullish thesis to be in play

A decisive break above the 200 day moving average is what we need, to gain confidence that this might be an emerging bull market

I believe the next two weeks price action, might give us the direction for the overall market the coming months

Today We Will Be Looking Under The Hood For Clues

Since we are at a critical levels in the stock market — we put in an extra effort this week, to produce an analysis, that truly dives into the underlying market mechanics.

Breadth observations

A look at how the IPO market is doing

While the major indices are pausing — what is the rest of the market doing?

Corporate insider activity

Corporate buybacks

Have shorts started covering yet?

Smart money and hedgers positioning is showing clues of where we might be heading

VIX and smart money bets on VIX direction

Two ETFs about to break out

We Will Be Increasing Prices Affecting Only New Subscriptions Tomorrow

Those who already are paid subscribers will always keep their subscribed price.

We’ve been priced well below the average Finance Substack for a while now — Tomorrow, we’ll be raising the price for new paid subscribers.

If you value the content and want to tag along, upgrade your subscription before the price hike.

The price you subscribe to, is always a lifetime price, as long as you don’t unsubscribe.

Biggest Indecision In A Long Time

The whole market is consolidating tightly. You will see this in Mondays setup post. There are an extreme amount of tight pivots and consolidations — mimicking the behavior of the major indices.

My personal bias is bullish, but we don’t guess, we follow price.

But lets look under the hood, and see if we find some clues, of where we might be heading.

Breadth In No-Mans-Land Taking A Pause

Looking at long term, medium term and short term breadth, we are now neither oversold nor overbought. We are simply taking a pause.

What follows a pause like this, is almost always a significant move — in either direction.

The Only Standout Breadth Observations I See Is That

Tech is still a little overheated in the very short term — it is the leading group of stocks, so this is expected

% Of Tech Stocks Above The 5 Day Moving Average

Small caps are still slightly outperforming the large caps — which is what we want to see in a reversal. I have in the past told you that small caps lead the decline, but also lead the reversal. Bottoming before the large caps.

Chart Of Russell 2000 And The S&P 500

IPOs Are Awakening

Which is great — in a risk on environment IPOs get alot of capital flow. We are seeing bullish action in alot of IPOs, for the first time in a while.

Renaissance IPO ETF Together With The S&P 500

As you can see in late February, a clue of the shift to bearish sentiment, was a risk off environment in IPOs. They showed weakness earlier than the S&P 500.

Right now, we are seeing the opposite, IPOs are outperforming the S&P 500. This is a sign of a risk on environment. A decisive breakout from here would be very encouraging.

Interestingly if we look at the start of the 2022 bear market, you could have seen the same early warning sign of a risk off environment, by watching how the IPOs were behaving.

I want to add that IPOs are volatile, and risk an off environment in IPOs, doesn’t necessarily mean an automatic bear market — but this is something useful to analyze continuously.

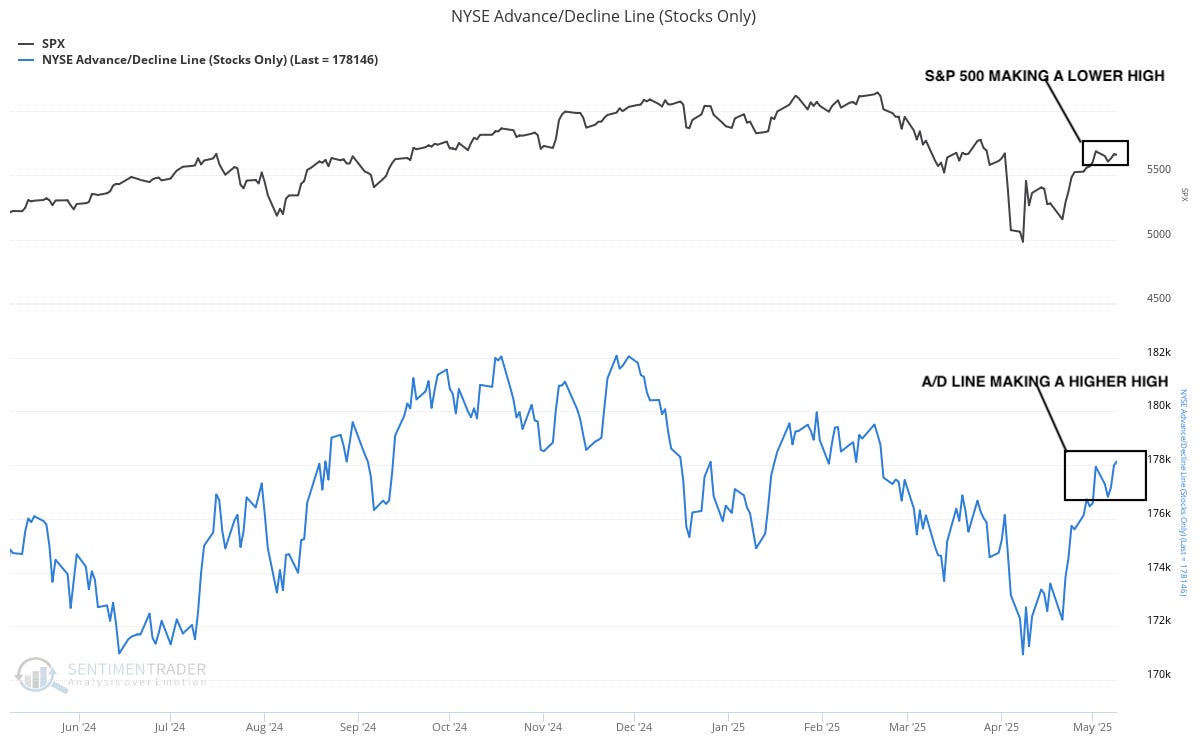

Stocks Are Advancing While The Indices Are Pausing

This is also a bullish sign, and what we want to see to believe that we can continue up.

The NYSE advance/decline line shows the daily net number of advancing minus declining stocks in all of the New York Stock Exchange — this shows the underlying direction and strength of the combined stocks in the NYSE.

While the S&P 500 is pausing or slightly declining, the broad market is advancing, with the NYSE advance/decline line making new highs.

(Source: SentimenTrader.com)

As you can see, it is a small divergence, but it is still there.

And the observation is also confirmed by other breadth momentum indicators like the McClellan oscillator.

Insider Transactions Showing A Change Of Character

Corporate insider transactions are always interesting. They are great market timers in the long run, since they know their business outlook the best. Insider sells may have many causes, therefore I always focus on insider buying activity, which is a more reliable signal.

Insiders have started to accelerate their buying, which is encouraging. But we need them to continue, since we are increasing from historically low levels, of insider buying.

But if we look at insider buying within XLK - the tech sector. They are already getting overly optimistic.

Since our typical growth stocks, are tech stocks — this is a very good sign for future price increase.

(Source: SentimenTrader.com)

As you can see, they do not always pick the exact bottom, but they almost always buy close to the bottom.

The strongest signal when analyzing corporate insider buying activity. Is when we have a dramatic increase of buying activity like we have now, it is usually a good sign for the stock market.

It shows the shift from excessively bearish sentiment to to excessively bullish sentiment.

The only other stand out sectors that comes close to the tech-sector insiders optimism, are the industrial, materials and healthcare sectors. Something to have in mind going forward.

Corporate Buybacks Hits Record High

Corporate buybacks help support stock prices, since it produces significant buying pressure in stocks. In March 2025, during the sharp decline, we saw very low levels of announced corporate buybacks.

April 2025 showed the second highest level of announced buybacks ever recorded.

And the heavy buying will continue since the overall projection for 2025 shows the highest level of planned corporate buybacks ever recorded.

This can help support stock prices — favoring a stock market increase.

We Are Too Shorted To Decline — And They Are Shorting Even More

Of course anything is possible. But the NASDAQ has never been this shorted before.

Generally, a high short interest is very bullish. Since the covering of shorts will fuel the rally further. A high short interest is a great ingredient for a bullish thesis and a significant bottom.

I told you two weeks ago that the short interest will increase as we advance, not decrease — well now that finally happened.

If too many are betting on a decline, the market will probably advance.

Since shorting is very seasonal, we are looking at a seasonally adjusted chart of the short interest.

(Source: SentimenTrader.com)

I want to add that shorting has naturally increased during the last 20 years. But comparing with recent years, together with the trend of the short interest — it speaks loudly anyway.

Smart Money Are Decreasing Their Hedging

Smart money are usually ahead of us, when they are worried they will hedge against the equity market heavily — like they just did.

When hedging reaches extremely high levels, like they did at the bottom, the likelihood of further decrease in the stock market are usually low.

The reasoning is that if smart money are heavily hedged, they have likely already sold equities, which limits further selling.

They have now started to decrease their hedging against the equity market, a sign that they might be more confident in stocks.

We saw a very similar pattern of extreme hedging and decreased hedging when the 2022 bear market bottomed.

The equity hedging index combines hedging methods as put buying, shorting, raising cash, buying inverse ETFs and buying credit default swaps.

(Source: SentimenTrader.com)

When hedging decreases we usually get a rally. But as you can see equity hedging decreases in a bear market rally as well.

So what we need to see from here coming weeks, is a further swift decline — Like when the real 2022 bear market bottom occurred.

This would indicate a real reversal and give confidence for a move up.

VIX Is Showing No Life

Even when the market is pausing in indecision, we see no indication of a spiking VIX — which is bullish.

I have also looked at smart money bets on VIX, and they are still net short VIX, and thus not expecting a dramatic increase in volatility.

This supports a bullish thesis.

VIX continues to make lower lows

The Bottomline

As I read the market there is clear risk on bias

But a lot of the sectors are showing fading momentum or a pause, just like the overall market

There is no way of knowing what the market will do next until it does it

But breakouts are still working and leading stocks are acting very bullish

If we can break above the 200 day moving average we will have a great window of opportunity — because we are not overbought, and we are not seeing massive retail positioning like we see at a market top

Even though there is a risk on bias, the sentiment and narrative can change quickly — we need to break the downtrend to be confident in the advance

The most important thing going forward is watching if the breakouts that have occured in leading stocks hold. If they start reversing into their previous ranges, that would be a big warning sign that more pain is expected — because they react faster than the overall market in a true bearish reversal

Finally there is no other indicator than price — we need price confirmation breaking the downtrend

Lastly I Want To Highlight Two ETFs About To Break Out

XLE

The energy sector is looking very bullish and has acted constructively after its sharp decline.

XLRE

And if the real estate sector breaks out from here, it might produce a significant move.

Hope this helps and thank you for reading, if you liked it feel free to share it, so the substack can grow.

Charts courtesy of SentimenTrader.com

https://sentimentrader.com/subscribe-newsletter

Charts courtesy of TradingView

Charts courtesy of TrendSpider

Disclaimer: The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.