Free Post - The Chart Tells The Tale - NVIDIA

Finding Asymmetry in Supply and Demand

Stocks move in very distinct phases and patterns. Identifying these is our job as swing and position traders. What mainly moves stocks is institutional and fund sponsorship. By studying and analyzing charts, you can identify the actions of smart money, and align your trading with their agenda. They are like elephants in a glasshouse and we are nimble as ninjas. Use that to your advantage.

The Four Phases of Stocks

1. Accumulation and Re-accumulation - Our Bread and Butter

Smart money accumulates stocks at lows and bases. When enough stocks have been accumulated, demand accelerates, and the stock becomes hard to catch. This drives the stock price up, the stock breaks out from their base and the uptrend begins.

Along the uptrend you will have smaller re-accumulations. These are essentially shorter bases in valid uptrends, where demand and supply briefly equilibrates. When enough stocks have been accumulated, the stock is again hard to catch and breaks out.

NVIDIA Weekly chart

2. Markup - Uptrend

Re-accumulations are simply pauses in the primary uptrend. We trade breakouts from re-accumulations to be part of the uptrend.

The uptrend is a phase where we have an asymmetry in supply and demand. Underlying constant demand leads to steadily increasing stock price.

We want to own stocks in this phase, when demand constantly is in control. If we handle the trade properly, we can capture a bigger move with very little risk. More on this in future posts.

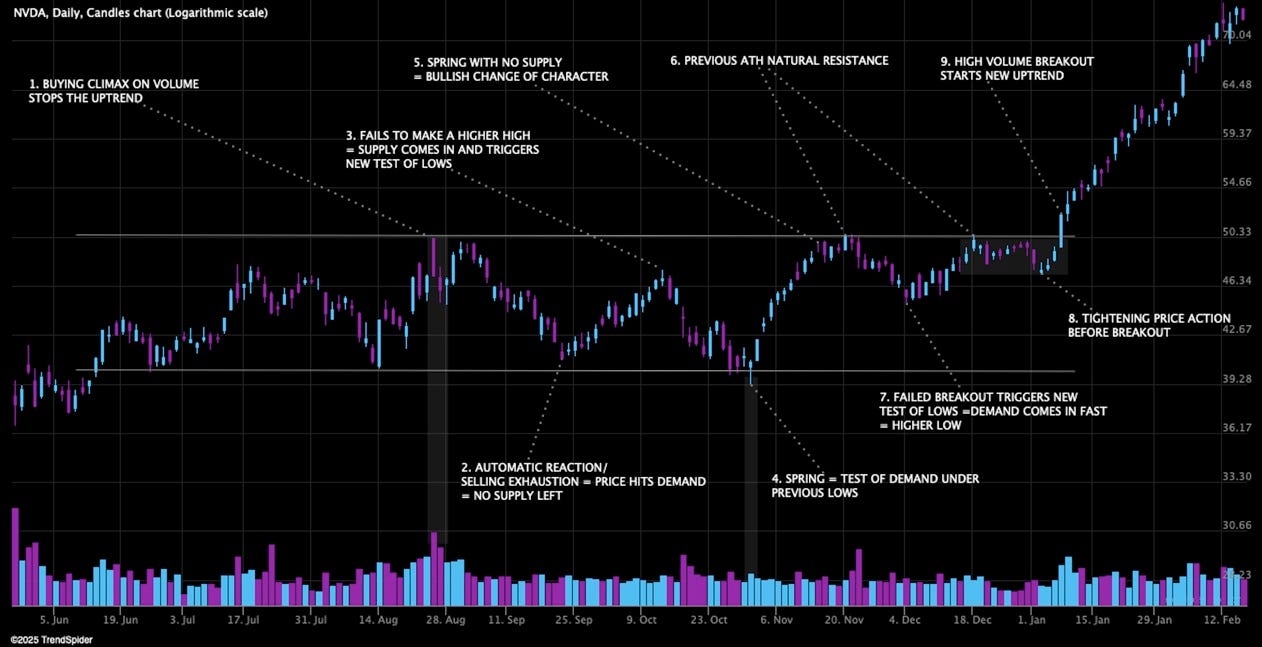

NVIDIA Daily chart

If we zoom in we will also see that all bases and re-accumulations have the same general timeless patterns and principles.

3. Distribution - All Good Things Must Come To An End

When the uptrend comes to an end, meaning supply is higher than demand, a distribution base will form.

The hallmark of distribution is a decline in institutional and fund sponsorship with subsequent systematic unloading of stocks. Smart money sell stock in a smart way. They do this with patience, selling every rally and breakout attempt. This can easily be seen in charts as I soon will show.

As time passes and the supply steadily increases, the selling will accelerate. Smart money will lower the price where they sell stocks, pushing the price lower. This is called the last point of supply according to Wyckoff. This will make the rallies weaker and the decline stronger.

Finally the stock will breakdown from the distribution base and start the last phase of a stocks lifecycle.

4. Downtrend - The Hopeless Downtrend

A steady downtrend is also an asymmetry between supply and demand. The supply is constantly higher than demand. Every rally is sold and the price continues to decrease.

Finally supply and demand equilibrates again and a new accumulation phase is started. This is the point when smart money views the stock as fairly priced again.

A Breakdown of NVIDIAs Chart

Until the breakdown occurs, the base can always change character and demand can come in.

But we want to participate when we have clear evidence of a bullish change of character. Evidence that buyers are in control. You want to participate at the inflection point after demand and supply have equilibrated — and asymmetric demand propels the stock higher.

What happened after this post was made — is that the base changed character, showing signs of life for the first time.

By analyzing timeless principles of supply and demand, you will be able to see when the sentiment turns and when the stocks are changing character.

This puts you in a powerful position, since you get in early at the start of the move.

Hope this helps and thank you for reading.

Feel free to share this post if you find the content useful so we can grow.

Charts from TrendSpider

Disclaimer: The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.