Because Last Weeks Post With Past Setups Did Not Fit Them All

Here are some great charts, enjoy!

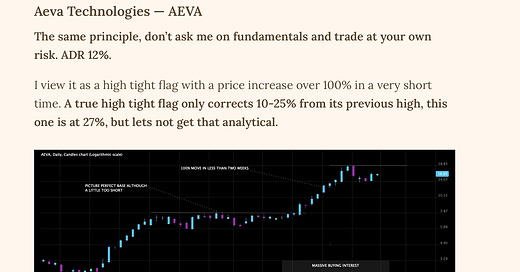

AEVA

Posted as a setup early as it was producing a high tight flag pattern.

Now Up A 100% In A Couple Of Weeks

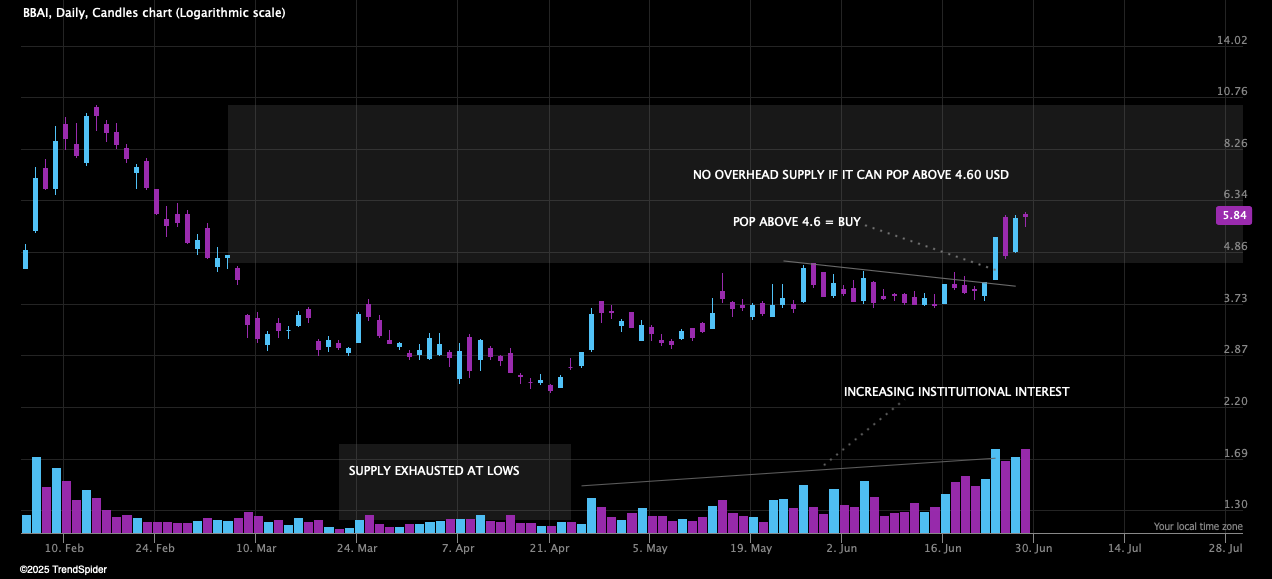

BBAI

Posted as a setup a while back, and again this Tuesday.

Up 40% In Four Days

SEZL

Made an insane earnings gap and I have followed the company for quite some time before that. From a post called “Put These Stocks On Your Watchlist Immediately” — highlighting the best earnings moves.

Up 90% With Ease Of Stride

RBLX

A never ending grinder. We posted three entry suggestions early on.

Now Up 50% stress free, respecting the 10 day moving average all the way.

CLS

Posted as a setup recently and performed very well.

Up 25%

RKLB

Highlighted early as a core name to monitor, because the aerospace and defense group was a leading one.

Up 50% From Suggested Entry

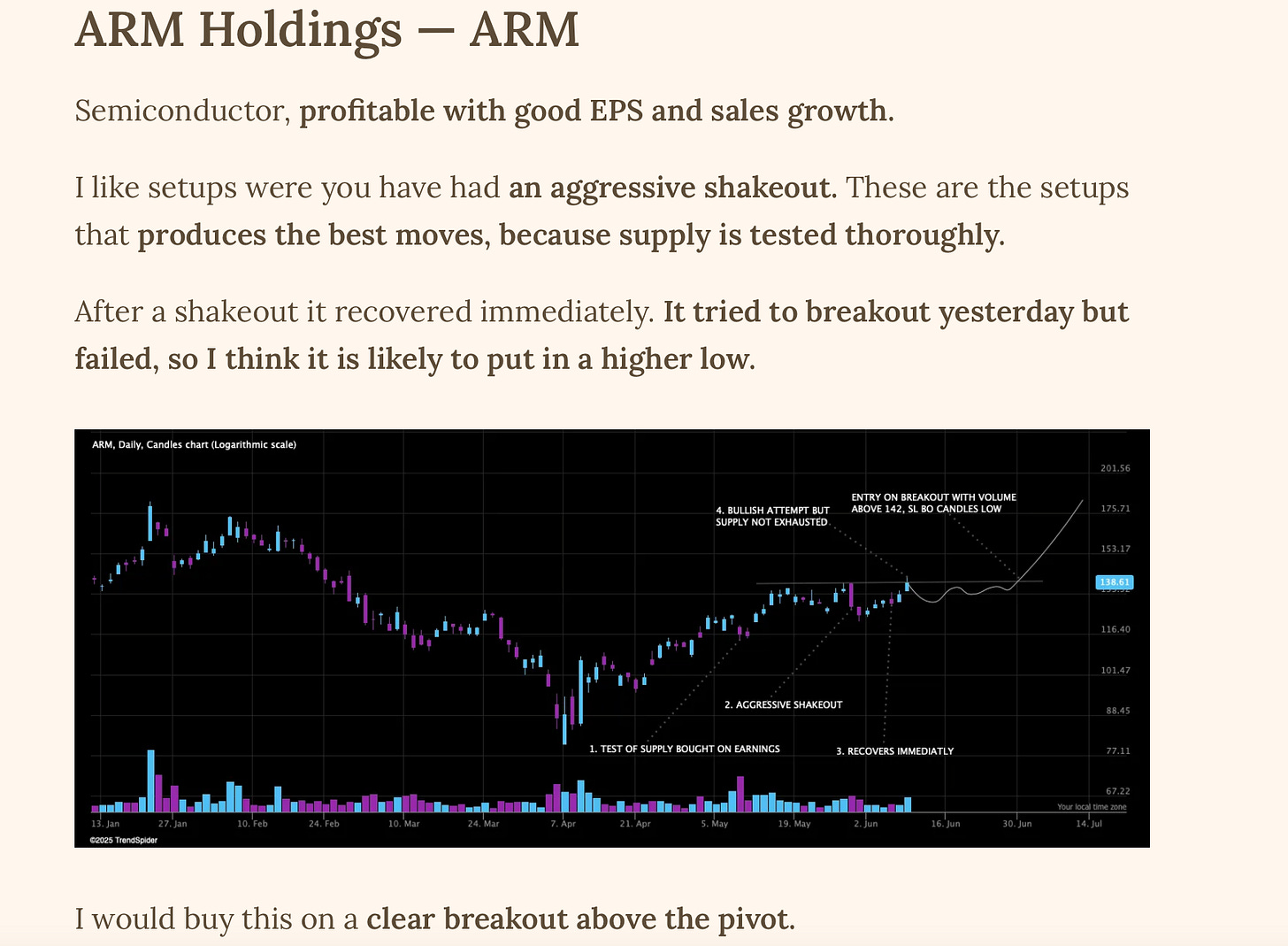

ARM

ARM had a very interesting setup because of the recovery after the shakeout. Usually what comes is a powerful move up, if it survives the shakeout.

Up 20%

KRMN

I have followed this stock since the day it IPOed. Finally broke out and is grinding up ever since. Posted as a setup several times, also after this post.

Up 30%

PWR

Posted as a setup after a nice earnings gap.

Trending Nicely After That

NFLX

I like trading the liquid leaders, because heavy capital flows into them, and they behave more rationally than smaller stocks.

We posted NFLX as a setup before it even broke out from the base. But this was a nice spot to catch it again.

Trended Up Nicely From The Bounce

DASH

Recent setup

Really Nice Move With Followthrough

AXON

Super interesting company, if you haven’t heard about it do it. Within the security group.

Up 20% In A Great Way

I have much more setups to show, but I can’t show them all.

Trusted By Over A 100 Paid Traders — For A Reason

We bring you the best stocks before they move, and analyze the stock market every week for you.

If This Is Something For You Join Our Community

Charts courtesy of TrendSpider

Disclaimer: The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.